Due to the global nature of modern day manufacturing, the importance of international relations cannot be underestimated. Supply chains have grown in intricacy and complexity, so with plants and suppliers based across the world, organisations need to be aware and understand geopolitical risks. These risks vary from economic sanctions, trade deals and distinct changes in political direction - all of which can significantly alter the costs of products across the wider supply chain.

With the growing trend of protectionis and “country-first approaches” to international trade, previously thought “stable markets” can be seen to quickly become economically volatile. Businesses have to be aware and analyse what economic sanctions could do to their business along with the impact it may have on the wider supply network.

“CEOs are beholden to the outputs of an increasingly complex geopolitical system” - Eurasia Group 2019

Natural disasters

The specific effect a natural disaster will have on manufacturers is unknown and inherently unpredictable. Highly integrated global supply chains provide many advantages, but a failure at a certain level within a supply chain can cause problems which are not immediately apparent but develop over time. The 2010 Icelandic volcanic eruption halted Nissan’s production of three car models (2,000 cars) due to the inability to import air pressure sensors from the Irish Republic. In addition, BMW in Germany had cut production, and in South Korea, Samsung and LG said they were unable to air-freight more than 20% of their daily electronics exports.

In just one month, the volcanic eruption shaved $5 billion off the global economy, bringing air travel to a complete stop [1] . Manufacturers’ need to be aware of natural disasters and swiftly identify pinch points in their supply chains as they represent a greater vulnerability in the events of unforeseen circumstances such as natural disasters. These can be identified through disaster recovery plans, and or business continuity plans.

Covid-19

The Covid-19 pandemic outbreak began in Wuhan, China, with the first case being reported in November of last year. The disease spread quickly, first across the Far East, then into Europe, with the first case in Europe being reported in January. As countries began to restrict movement and places of work were closed, it wasn’t long before the impact of the lockdown was felt on integrated, complex manufacturing supply chains spreading across the world.

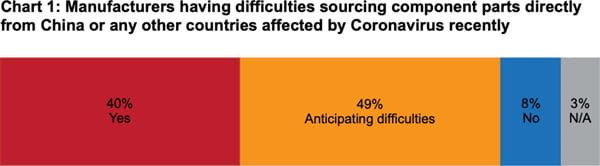

In particular, 31% of small manufacturers sourced components parts directly from China or other countries affected by coronavirus, increasing to 65% for large manufacturers. So it was unsurprising that this supply-side shock meant 40% of manufacturers said they had experienced difficulties in sourcing components, with a further 49% anticipating difficulties in the weeks ahead . [2]

Source: Make UK YouGov survey of 244 manufacturers between 4th - 16th March 2020

As components or parts were held up it was clear it was only a matter of time before production in the UK would have to be halted. The automotive and aerospace industries were particularly badly hit – with plummeting demand and an inability to source components leading to many Original Equipment Manufacturers (OEMs) halting production.

Most of the current and anticipated difficulties were centred around an increase in lead times due to delays and or restrictions on production (80%).

In addition to the supply-side challenge of sourcing parts and components, the cost of getting these parts to the UK also increased. Almost half of manufacturers estimated their freight costs to and from countries have risen since the Coronavirus epidemic broke out by between 6-10%. At a time when margins were already tight, additional monetary costs, as well as delays, have no doubt caused supply chains to grind to a halt.

Behaviour change strikes again

The lockdowns imposed by countries across the world also dramatically changed consumer behaviour in a very short space of time. In particular, demand for retail products went up sharply, while demand for wholesale products fell due to the closure of offices, schools, restaurants, shops and hotels. This switch was largely behind early shortages of things like toilet paper, eggs and tinned goods: and wholesale supply chains (such as industrial catering suppliers) took time to shift their focus to the retail market. It’s also interesting to see the wider impact of these changes – for example increased demand for packaging. Early shortages in hand soap were caused more by a lack of suitable bottles than by a reduced supply of the soap itself.

The Great Financial Crisis

The financial crisis was another supply-side shock that had ramifications for supply chains in the manufacturing sector. Unable to access credit, investment fell, output plummeted and productivity stagnated. Make UK’s own analysis found employment in the sector declined to -7% on balance in 2008 Q3 peaking at its worst at -40% in 2009 Q2 and a record low of -52% on balance of output change between 2008 Q3 and 2009 Q2 [3] . Recovery from the financial crisis was slow, with the manufacturing sector’s Gross Value Add (GVA)declining on average by 2% quarter on quarter, between early 2008 and late 2009 (resulting in almost 6 consecutive quarters of decline) therefore, early talk of a ‘V-shaped’ economic recovery should take heed, and learn lessons of what impact the crisis had throughout supply chains across the manufacturing sector.

The end of free trade?

Even before the current pandemic, the idea that the world was moving gradually towards ever liberalising international trade – overseen by international bodies such as the World Trade Organization – was coming under pressure. In various parts of the world, we have seen political considerations take precedence over economic ones, with trade barriers such as tariffs being erected and even trade wars breaking out. Assumptions businesses may have made when designing their business models and supply chains may no longer be valid, as trade policy becomes more unpredictable and subject to significant change.

What can we learn?

Design a resilience plan: Create a resilience plan which would identify failures within the supply chain and model the impact it would have on your business. Understand the blind spots in your supply chain or network, from Tier 1 suppliers to OEMs, any disruption could potentially impact your business. This includes:

- Do you know where all of your products are sourced? Even the “small things” (nuts, bolts, gloves, lubricants, PPE, packaging)

- Do you have backup sources for these products if your usual supplies are unavailable?

- If there was an 8 week delay in receiving a vital component, how could your business pivot and adapt? Zero cross-border travel for one week (no plane, train or road journeys across international borders). Consider for example, the impact of a sudden change in a country’s travel advice.

- What would a 10% import tariff on raw materials or a 10% export tariff on finished products do to your business model?

- What role can technology play in improving resilience – for example in supporting remote monitoring and working?

- Is there a case for simplifying and shortening some supply chains?

And finally, apply lessons from the current crisis: the manufacturing businesses that have been most resilient to the COVID-19 impact are those that understand their supply chains; are more digital – both in terms of production and sales – and have got clear backup plans in place if a supply-side failure occurs. As a sector we need to come together and learn from our present experience to ensure we are properly equipped to prosper in an uncertain future.

Blog authors Bhavina Bharkhada (Make UK Senior Campaigns & Policy Manager) and David Fagan (External Affairs Executive). Get involved in the conversation @MakeUKCampaigns @SCMOracle @OracleERPCloud #MakeitSmart

Sources

[1] Oxford Economics, The Economic Impacts of Air Travel Restrictions Due to Volcanic Ash, 2010

[2] Make UK YouGov survey of 244 manufacturers between 4th - 16th March 2020

[3] Make UK Manufacturing Outlook data, 2007-09