In summary

The EBDS will run from 31 March 2023 until 31 March 2024 and will have two elements to it:

1. Universal support, for all except Energy and Trade Intensive Industries (ETIIs), which will cover 100% of energy volume usage (based on December usage).

Customers do not need to apply for their discount. As with the current scheme, suppliers will automatically apply reductions to the bills of all eligible non-domestic customers.

This universal scheme will apply to customers:

- on existing fixed price contracts that were agreed on or after 1 December 2021

- signing new fixed price contracts

- on deemed / out of contract or standard variable tariffs

- on flexible purchase or similar contracts

- on variable ‘Day Ahead Index’ (DAI) tariffs (Northern Ireland scheme only)

2. Support for Energy and Trade Intensive Industries (ETIIs) only, will cover 70% of the energy volume usage to more energy and trade exposed industries.

ETII companies (defined further below) will have to actively apply to receive the ETII support. The application process will be in place before the end of March. The application route has not been determined yet.

The 70% of energy volume usage is dictated by the fact that EBDS is a subsidy and therefore must comply with the European Ukraine Temporary Framework.

For the remaining 30% of energy volume usage, ETIIs will get the universal level of support instead of market wholesale prices.

Businesses will receive a discount reflecting the difference between a price threshold and the relevant wholesale price. This means that businesses experiencing energy costs below this level will not receive support.

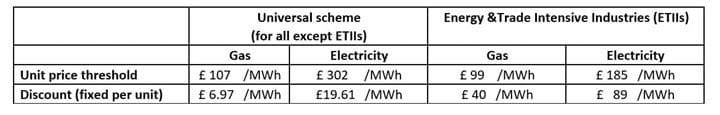

The wholesale gas price thresholds above which the support will be triggered are as follows for each of the two schemes:

As an indicative example from Government: An ETII qualifying medium-sized manufacturer using 1,600 MWh of gas and 200 MWh of electricity each month, under the new ETII scheme, could receive up to £687,120 of taxpayer funded support in the 23/24 financial year.

In more detail

For those whose usage falls under but very close to the threshold points, there will be adjustments of the discount. BEIS/Treasury will be working with energy suppliers to determine the details of the discount in these cases.

Not every manufacturing business is in scope of the ETII discount

The definition of ETIIs for this scheme is wider* than that of the existing EII compensation schemes, however, not all manufacturing sectors are included.

How to know if you are in scope of the Energy and Trade Intensive Industry discount?

ETIIs, were identified during the review of the current EBRS scheme as those meeting certain thresholds for energy and trade intensity, in addition to sectors currently included in existing Energy Compensation and Exemption schemes. Energy intensity was based on electricity and gas consumption as a % of a sector’s GVA using ONS data. Trade intensity was based on goods trade using ONS data. To qualify as an ETII sector, the sector had to be above the 80th percentile for energy intensity (i.e., fall in the top 20% of sectors by energy intensity across the UK), and the 60th percentile for trade intensity (i.e., fall in the top 40% of sectors by trade intensity across the UK).

These cut-offs have been used to arrive at the list of qualifying SIC codes published with the announcement. This SIC code list serves as the reference for identifying whether your company qualifies as an ETII or whether it falls under the universal scheme.

There are no plans for installation - or business-level tests on energy or trade intensity. Whether a business is eligible is based on whether the firm's primary SIC code registered with Companies House is on the eligible list. Therefore even if part of some business activities fall within eligible SIC code, these activities will not be eligible as the business’s primary SIC code is not on the list (unless they have actually registered some specific activities as a separate business with its SIC code).

Guidance for firms that believe their operations are not correctly classified by Standard Industry Classification (SIC) code will be published by the end of March 2023.

What next?

BEIS will be working during the next few weeks on how the ETTI scheme will apply in detail and how it will function and will be publishing further information by the end of March 2023.

Make UK will be seeking to better understand the calculations for the SIC code selection and the relevance for your businesses, and will provide updates as necessary.

Make UK will be hosting a live webinar with Advantages Partner Inspired Energy,

Make UK Energy Market Update with Inspired PLC at 1pm on 24 January 2023.